Assessors use the direct capitalization income approach to assess income-producing real estate but generally use the sales comparison approach when valuing owner-occupied commercial properties. In other words if you purchased a commercial property for 500000 and it generates 70000 in gross rents each year your GRM would be about 714 or 500000 70000.

A Cre 101 Using The Income Approach To Value Commercial Property

The Commercial Appraiser might lend greater weight to the income approach as the lead value indicator.

. The Income Method simplified is. If you have tenants in the property those tenants should be paying you rent. The income capitalization approach to real estate appraisal is also commonly referred to as the income approach and is mostly used for commercial properties not residential.

To find the value of a property using the income approach to value if the net operating income and capitalization rate were known the appraiser would. This appraisal method is the sales comparison method. If the property is old we must also find out how much value the building has lost over time.

When there are no comparable sales in the year of assessment or other data to support an increase or decrease in a propertys assessed value remains the. This calculation can be done in one of two ways using either gross potential income GPI or gross operating income GOI. Build a Solid Portfolio with CXRE.

The type of commercial appraisal method used to evaluate your property depends on the circumstances location and earning potential. - Multiply the effective gross income by the capitalization rate. - Multiply the net operating income by the capitalization rate.

The direct capitalization method estimates property value using a single years income forecast. This invaluable resource covers all key elements of commercial property valuation including valuation queries real. Commercial Income Producing Properties also use the sales comparison method but not as the primary determining factor.

The income approach applies a multiplier called a capitalization rate to its income. Whether you are looking to buy or sell a piece of commercial property you will need to have a commercial property appraisal done at some point before closing. This type of appraisal uses models to predict the behavior of market participants in particular with regard to commercial income-producing properties.

This differs from owner-user type property appraisal. Lets take a look at both methods in some more depth. The quantity survey method.

The gross income multiplier method is often used to appraise other properties that are not purchased as income properties but that could be rented such as one and two-family homes. The square foot method cubic foot or comparative unit method. The GRM method relates the sales price of a property to its expected rental income.

And the trended historical cost method. To find the value of a property using the Income Approach to value if the Net Operating Income and capitalization rate were known the appraiser would. Valuation Methods for a Commercial Real Estate Appraisal.

The method that is predominant in determining the value of income producing property is the income method. - Divide the net operating income by the capitalization rate. The Property Assessment Valuation Second Edition defines the methods of cost estimating as The methods of estimating current cost may be placed in four categories.

A practical guide to the best approaches for commercial real estate value assessment Commercial Property Valuation provides a comprehensive examination of principles and methods of determining the accurate value of commercial assets. Another method of determining the value for a commercial property is to see what it would cost to replace the building. Gross Income Multipliers GIM Cost Approach.

Multiply the Net Operating Income by the capitalization rate. The unit in place method. The income approach to appraisal encompasses both the direct capitalization method and the yield capitalization method.

This approach is preferred when appraising an income-producing property. The value estimate is much better using gross operating income because losses for occupancy and non-payment are considered. If they do that income stream is one method appraisers use to determine the value of a commercial property.

Divide the net operating income by the capitalization rate. The Gross Rent Multiplier GRM valuation method measures and compares a propertys potential valuation by taking the price of the property and dividing it by its gross income. Divide the Net Operating Income by the capitalization rate.

Commercial income producing property is best appraised using this method Cost approach The method used to figure the Value figures the land separately from values of the improvements. In todays market lenders typically require an appraisal prior to. This appraising property method is based on the cost of building an identical structure at present.

Multiply the Effective Gross Income by the capitalization rate. Sales Comparison Approach Comparison Method Income Capitalization Approach or Income Approach Direct Capitalization. While both methods follow the idea that income determines value the direct capitalization method considers the current cash flow value while the yield capitalization method factors in year-over-year rent growth and cost fluctuations.

The Direct Capitalization Method. Direct capitalization requires that there is good. For residential properties the gross monthly income is typically used.

The income measure can be Potential Gross Income Effective Gross Income or Net Operating Income. This approach is usually most appropriate for income producing commercial properties. Adding Value to a Property.

Commercial Real Estate Appraisers use the Income Approach to value in the analysis of income-producing properties. To find the value of a property using the income approach to value if the net operating income and capitalization rate were known the appraiser would.

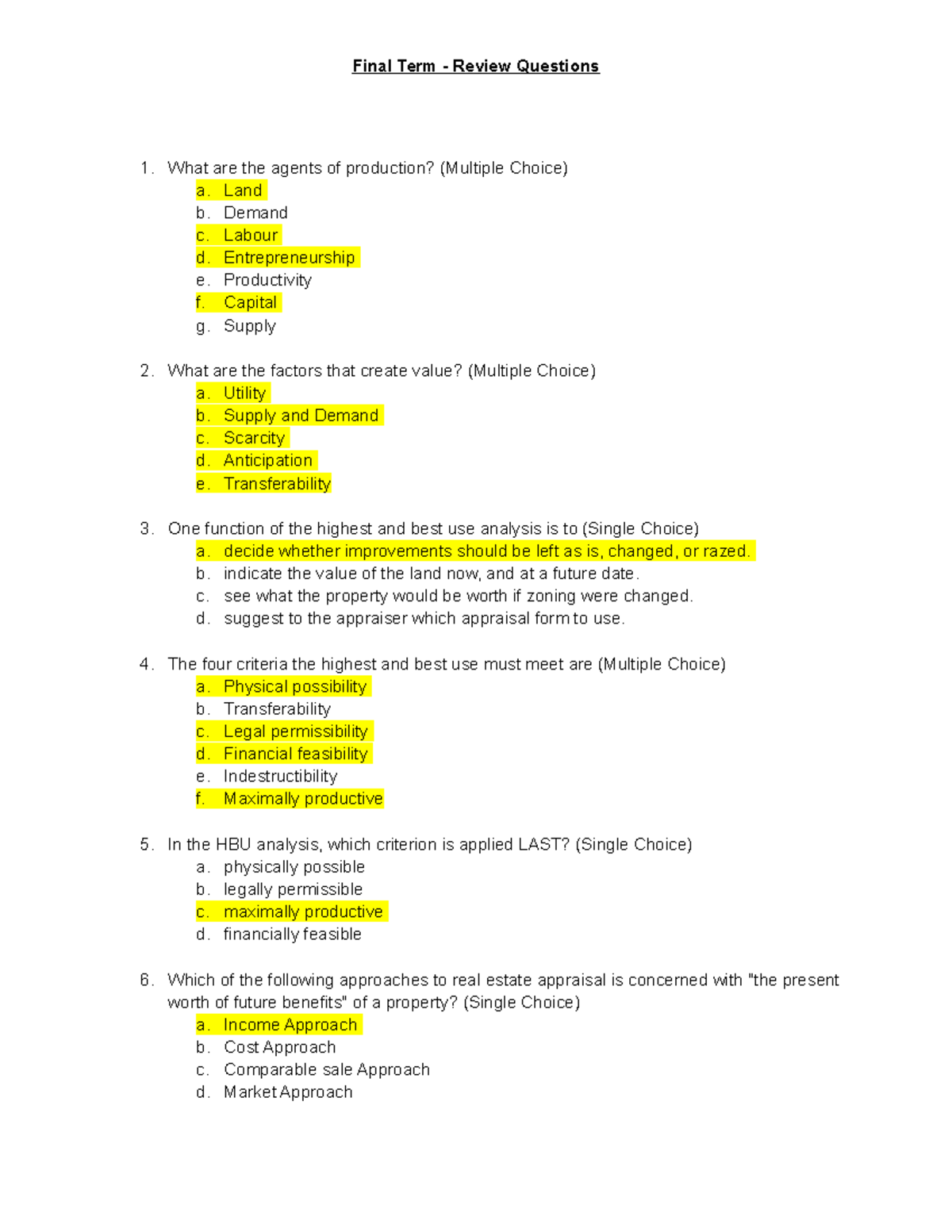

Final Term Review Questions Rem 300 Real Estate Management Studocu

0 Comments